The College Football Playoff quarterfinals are officially here. The Cotton Bowl kicks things off tonight, with the remaining three games set for New Year’s Day, and for fans who have waited until the final window to buy, the ticket market is offering more opportunity than you might expect.

At this stage of the calendar, CFP pricing usually tells one of two stories: either a late rush tightens the market quickly, or supply holds and buyers gain leverage. This year, it has mostly been the latter. While individual games have taken different paths to get here, the common thread is that entry-level options remain available across the board, even as premium seating continues to command a sharp upgrade.

The Cotton Bowl has been the most volatile example of that journey. Prices dropped dramatically after Texas A&M was eliminated, flooding the market with affordable upper-level and standing-room options. As kickoff has approached, pricing has firmed back up — not into panic territory, but into a more balanced range that reflects Ohio State’s national pull, Miami’s momentum, and the reality of remaining supply.

Across the rest of the quarterfinal slate, the story is similar but less extreme. The Rose Bowl and Orange Bowl have trended steadily in buyers’ favor, while the Sugar Bowl has held firmer as demand concentrates in better seating tiers. The result is a market that, taken as a whole, still rewards patience.

For fans making last-minute decisions, this is a rare window where marquee playoff games and rational pricing overlap. The sections below break down how each matchup arrived at this point — and what the current market says about where value still exists.

Quarterfinals: Early resets, not late squeezes

The Cotton Bowl is the clearest example of how this phase of the market has played out. The sharp drop between 12/19 and 12/22 was driven by a flood of upper-level and standing-room inventory after Texas A&M fell out of the picture. That reset pulled the average price down dramatically and created one of the most buyer-friendly entry markets of the quarterfinal round.

What’s notable is what did not happen after that point. Prices did not snap back aggressively as kickoff approached. Instead, the market stabilized. With the corrected average now sitting in the low-$900s, the Cotton Bowl reads as a balanced market — Ohio State’s national draw keeping demand intact, Miami adding intrigue, and enough remaining supply preventing a true late-stage squeeze.

Ticket Club Cotton Bowl “Get-In” Prices by Stadium Section:

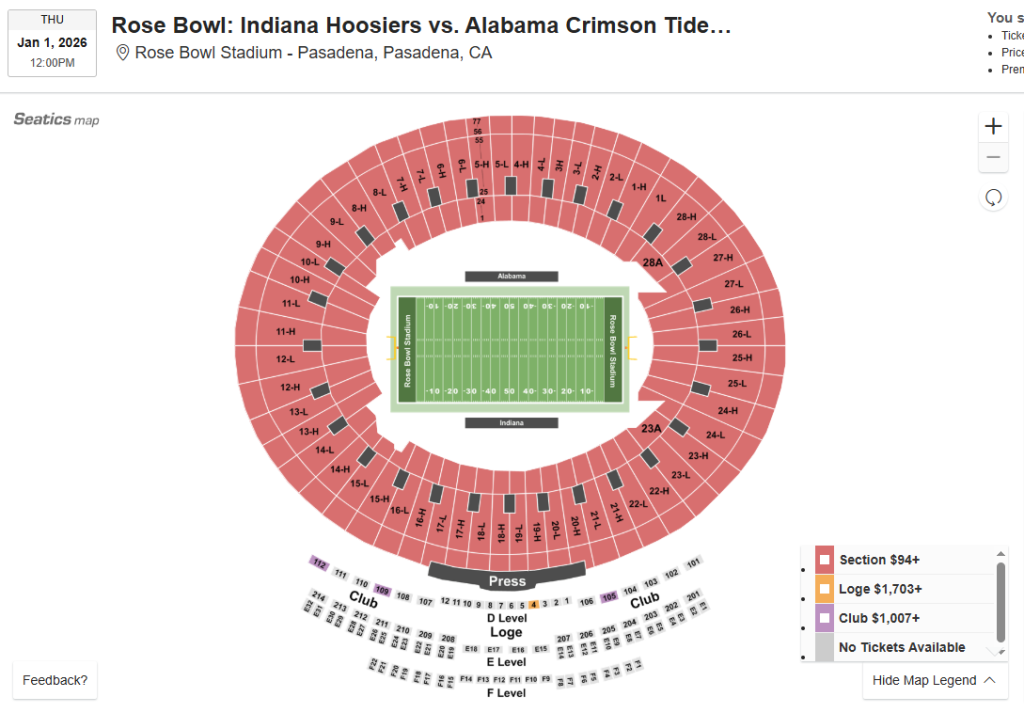

The Rose Bowl followed a similar but less extreme pattern. Even with Alabama officially in the field, prices softened by the 12/22 checkpoint and continued drifting lower into New Year’s Eve. Entry pricing has remained approachable for a New Year’s Day Rose Bowl, reinforcing the idea that brand power alone doesn’t guarantee pricing pressure when capacity is large and supply is deep.

Ticket Club Rose Bowl “Get-In” Price by Stadium Section:

The Orange Bowl also settled quickly and never really deviated. Prices eased modestly by 12/22 and continued sliding, a classic neutral-site dynamic where the market finds its level early and sellers stay competitive right up to kickoff. For a matchup featuring Texas Tech’s playoff debut against Oregon, this has quietly become one of the most value-oriented games on the board.

Ticket Club Orange Bowl ‘Get-In” ticket prices by Stadium Area:

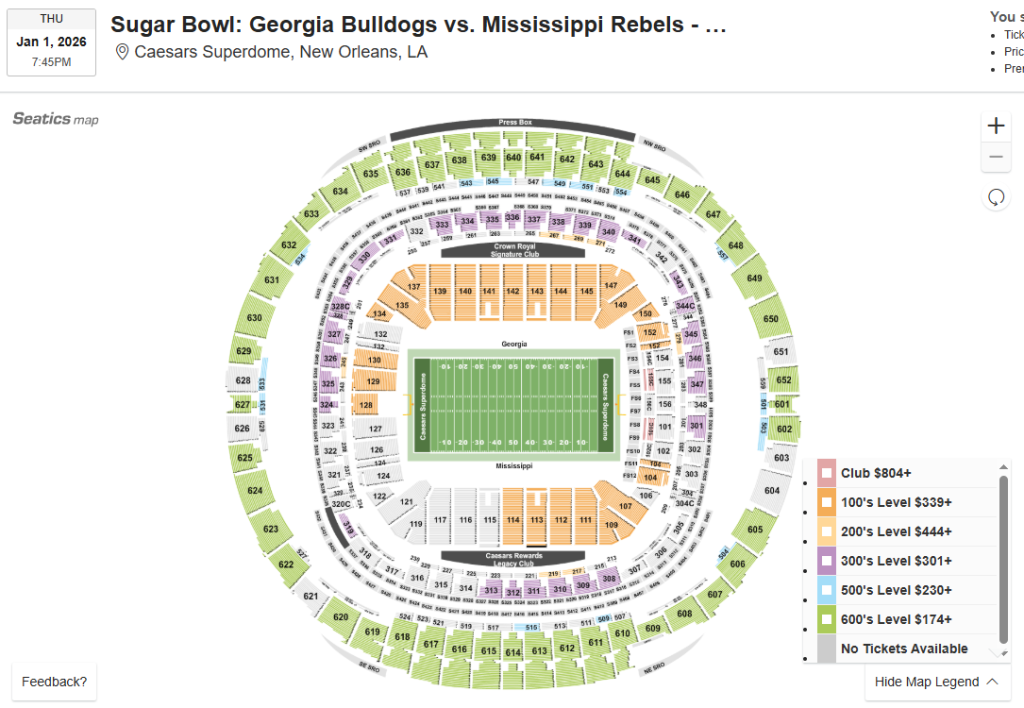

The Sugar Bowl remains the outlier among the quarterfinals. While it reset early like the rest of the field, it has held firmer than most. The entry tier has stayed manageable, but buyers have clearly competed for better sections. That concentration of demand in the middle and upper-middle of the seating map explains why this game has resisted the broader softening seen elsewhere.

Ticket Club Sugar Bowl “Get-In” Ticket Prices by Stadium Area:

Semifinals and championship: Pricing on expectation, not urgency

The semifinal markets have behaved exactly as expected at this stage. Both the Fiesta Bowl and Peach Bowl found stable ranges by 12/22 and have largely held them. Entry points remain accessible relative to the stakes, while club and hospitality inventory continues to live in a completely different price universe.

That’s not hesitation — it’s anticipation. These games are being priced on who might advance, not who is locked in. Once the quarterfinal field narrows, semifinal pricing is typically where directional movement shows up fastest.

The National Championship remains in its own category. Even during the 12/22 reset window, pricing barely moved. The title game doesn’t need urgency to stay expensive, and it doesn’t need matchup certainty to maintain a high floor. Historically, it’s the market that waits the longest — and then reacts the quickest once finalists are known.

The table below shows where average pricing stands now relative to the 12/22 reset. Rather than a story of volatility, it confirms which markets found their footing early and which ones have continued to drift in buyers’ favor.

| Date | Game | Avg. Price (12/31) | Change since 12/22 | |

|---|---|---|---|---|

| 12/31/2025 | Cotton Bowl: Ohio State vs. Miami (Quarterfinal) | $916 | +56.8% | Buy Tickets |

| 1/1/2026 | Orange Bowl: Texas Tech vs. Oregon (Quarterfinal) | $174 | -59.9% | Buy Tickets |

| 1/1/2026 | Rose Bowl: Indiana vs. Alabama (Quarterfinal) | $291 | -46.9% | Buy Tickets |

| 1/1/2026 | Sugar Bowl: Georgia vs. Ole Miss (Quarterfinal) | $537 | -17.4% | Buy Tickets |

| 1/8/2026 | Fiesta Bowl (Semifinal) | $799 | +4.3% | Buy Tickets |

| 1/9/2026 | Peach Bowl (Semifinal) | $742 | -5.4% | Buy Tickets |

| 1/19/2026 | CFP National Championship | $5,529 | -6.6% | Buy Tickets |